Synopsis

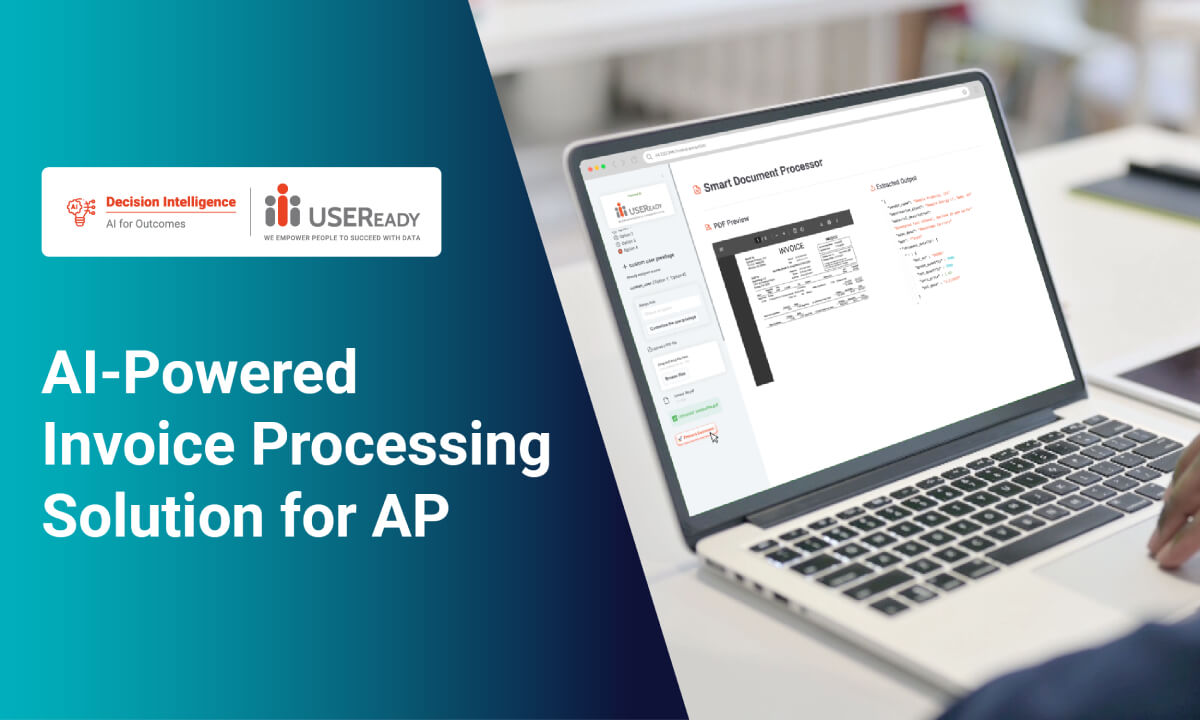

A leading midstream energy enterprise needed to manage over 360,000 annual invoices and bill-of-lading documents arriving in dozens of formats. Its traditional OCR-based invoicing automation failed to keep pace, resulting in delayed vendor payments, strained cash flow, and extended month-end closings. USEReady deployed its AI-powered invoice processing solution, enabling the finance team to cut days from closing cycles, free up more than $50M in working capital, and build greater financial agility for the company.

Customer

The customer is a North American midstream energy company responsible for transporting and distributing fuels across multiple plants and stations. Its operations generate massive volumes of financial documentation tied to material shipments, purchase orders, and vendor invoices. The finance team’s Accounts Payable (AP) function, critical to these operations, was struggling to ensure timely reconciliation and payment. With high document volume, vendor diversity, and regulatory oversight, the AP department needed a solution that balanced accuracy, speed, and control.

Business Challenge

Despite investments in OCR and RPA, the company’s AP team faced persistent bottlenecks. OCR templates could not handle the variety of document formats i.e. scanned images, handwritten BOLs, multi-page PDFs, and email-embedded invoices. This resulted in:

Over 360,000 documents per year requiring manual intervention

More than $72M in accounts payable stuck in processing

Frequent vendor payment delays impacting relationships

Month-end close cycles stretching beyond 9 days, limiting financial visibility

For the CFO and finance executives, the challenge was no longer just operational inefficiency but the risk to working capital optimization and liquidity planning.

USEReady Solution

USEReady developed an AI-powered invoice processing solution built on Document AI and large language models (LLMs). Unlike template-based OCR, the solution adapts to invoices of any format, instantly recognizing vendor, PO, pricing, and logistics details across diverse layouts. The solution featured:

Intelligent field extraction across 13 key data points, including Vendor, PO Number, Material Description, Quantity, and BOL details

Multi-page and multi-format processing, handling handwritten, scanned, and embedded documents seamlessly

Human-in-the-loop feedback, allowing quick corrections and continuous model learning

Native ERP integration, feeding approved invoices directly into SAP with complete audit trails

This approach shifted AP automation from rigid templates to adaptive intelligence, aligning with the company’s financial control objectives.

Key Outcomes

The solution transformed the AP function into a strategic enabler for finance, delivering measurable improvements:

$50M+ cleared in pending accounts payable

1.5 days saved in monthly close cycles (from 9 days to 7.5 days)

360,000+ tickets processed annually without template maintenance

Stronger vendor confidence through timely, accurate payments

Enhanced cash flow visibility for financial planning

Lessons Learned

The project proved that true value in AP automation achieved when it is aligned with financial strategy, not just efficiency metrics. The customer’s finance leadership recognized three critical lessons:

Flexibility matters

AI’s ability to adapt to diverse formats freed AP from OCR’s rigidity.

Financial impact drives adoption

Working capital gains and shorter closes made automation a board-level conversation.

Trust is built in the loop

Human feedback ensured accuracy, boosting confidence in automation across the finance function.

By reframing invoice automation as a cash flow and control lever, the company moved beyond cost savings to realize enterprise-wide financial benefits.

Conclusion

For enterprises where liquidity, compliance, and vendor trust are mission-critical, traditional OCR-based AP automation falls short.

By adopting an AI-powered approach, the customer not only streamlined invoice processing but also unlocked strategic financial outcomes proving that in today’s economy, automation is not just about speed, but about resilience and agility in financial management.

Schedule a Demo

Media Coverage

Media Coverage Press Release

Press Release